Introduction: Two Different Games

Investing isn’t one-size-fits-all. Some people chase quick gains. Others play the long game. Both approaches can work, but they require different mindsets, strategies, and expectations. Are you investing for the next year, or the next decade? This lesson will help you:

What is Long-Term Investing?

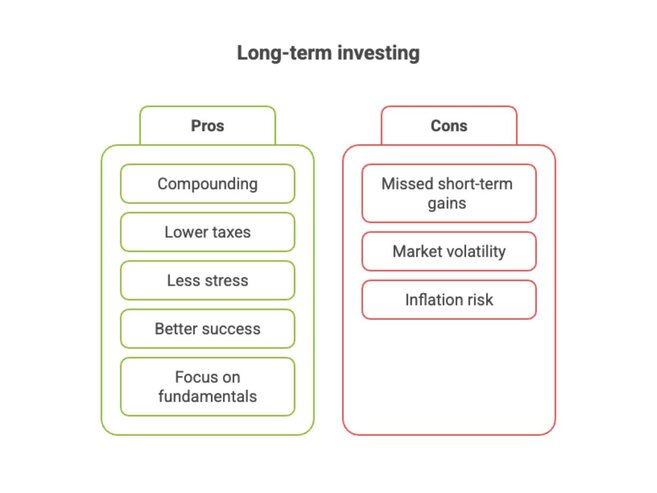

Long-term investing means holding onto your investments for years or decades, not days or weeks. It’s about patience, compounding, and big-picture thinking. What it Focuses On: Benefits: Real-World Examples: Long-term investing isn’t about predicting the next big thing, but about trusting the process and letting time grow your wealth.

What Is Short-Term Investing?

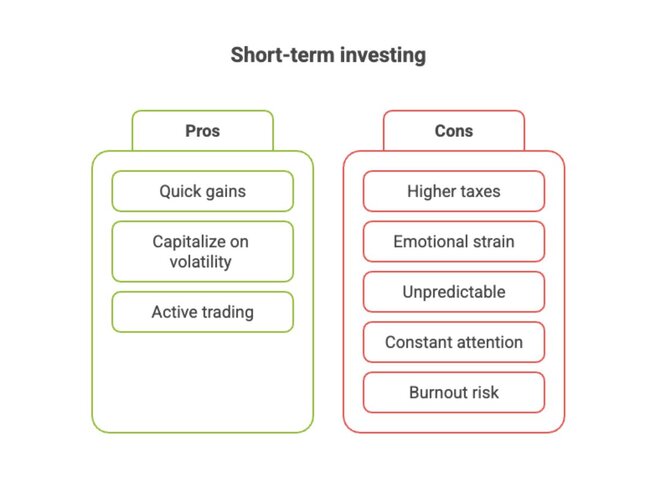

Short-term investing is about making moves over days, weeks, or a few months. It’s fast-paced, timing-based, and not for the faint of heart. What it Focuses On: Risks and Realities: Who Might Use It: Short-term investing can feel exciting. But without discipline and deep knowledge, it’s a fast track to frustration.

Key Differences in Approach

Long-term and short-term investing don’t just have to do with the timelines. They also require completely different mindsets and skill sets. Mindset Strategy Costs and Taxes Risk Tolerance Know which approach fits your goals, lifestyle, and comfort with risk, because forcing the wrong one usually leads to frustration.

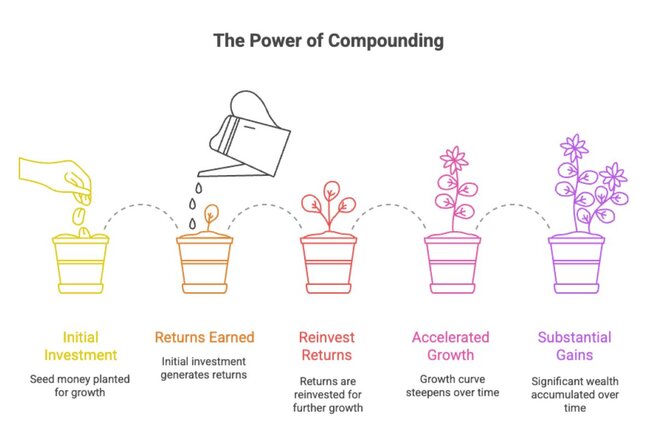

The Power of Compounding

Compounding is the secret weapon of long-term investors.

It’s how money earns more money, and then that growth earns even more.

How it Works

- You earn returns on your initial investment

- Then you earn returns on those returns

- Over time, the growth curve gets steeper, and the gains accelerate.

Example:

$10,000 invested at 8% annually grows to:

- $21,589 in 10 years

- $46,610 in 20 years

- $100,626 in 30 years

You didn’t work harder. You just gave it time.

Why It Favors Early Starters

- The earlier you begin, the more compounding works in your favor

- Waiting even five years can mean tens of thousands lost in future gains

- Long-term investing rewards patience, not perfect timing.

Time isn’t just money; it is the multiplier of money. The longer your money works, the harder it works for you.

When Short-Term Makes Sense

While long-term investing builds wealth, short-term strategies can play a role in specific scenarios, but only with clear purpose and caution.

Use Case: Short-Term Goals

- Saving for something within 1–3 years (e.g., a down payment or vacation)

- Prioritizing liquidity and capital preservation over returns

Tactical Moves (For Advanced Investors)

- Making short-term trades based on news, earnings, or technical signals

- Occasionally rebalancing around market cycles

- Hedging parts of your portfolio during volatility

- Taking profits in frothy sectors while holding long-term positions elsewhere

But Know the Limits

- It’s mentally and emotionally demanding

- Requires time, attention, and discipline

- Most retail investors lose money chasing short-term gains

Short-term investing is the tool with the sharpest edge. Use it wisely, or stick with what builds wealth over time.

Quiz

Which is a key benefit of long-term investing?

a) Faster profits

b) Tax-free trading

c) Compound growth over time

What’s a major drawback of short-term investing?

a) You can’t buy stocks

b) It is illegal in retirement accounts

c) It is high stress and often leads to lower returns

3. Who is most likely to benefit from a short-term investment strategy?

a) Someone saving for a house in two years

b) A 25-year-old investing for retirement

c) Someone with no interest in the stock market

See the answers at the bottom

Exercise: Match the Goal to the Strategy

Which investment approach fits best?

Match each scenario to long-term or short-term investing:

- Saving for a child’s college in 18 years

- Planning a vacation next summer

- Building retirement savings over decades

- Hoping to flip a stock based on an earnings report

See the answers at the bottom

Summary and Key Takeaways

- Long-term investing is about compounding, patience, and consistency, and it’s how most people build real wealth.

- Short-term investing can serve specific goals or opportunities, but it comes with higher risk, stress, and tax consequences.

- Know your time horizon and match your strategy to your needs - not your emotions.

- Compounding doesn’t reward perfect timing; it rewards the time in the market.

Final thought: Speed isn’t a must; consistency is. Let time work for you, not against you.

Answers to the Quiz and Exercise Questions

Quiz Answers:

1) Which is a key benefit of long-term investing?

Answer: c) Compound growth over time

2) What's a major drawback of short-term investing?

Answer: c) It is high stress and often leads to lower returns 3) What’s the biggest danger during a market downturn? Answer: a) Someone saving for a house in two years Exercise Answers:

1) Long-term, 2) Short-term, 3) Long-term, 4) Short-term

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.