Introduction: The Game You Are Already Playing

Every financial decision—saving, spending, investing—is part of a game. Winners? They understand 3 key rules: Understand these, and money starts working for you.

Risk vs. Reward: What Playing It Safe Really Costs

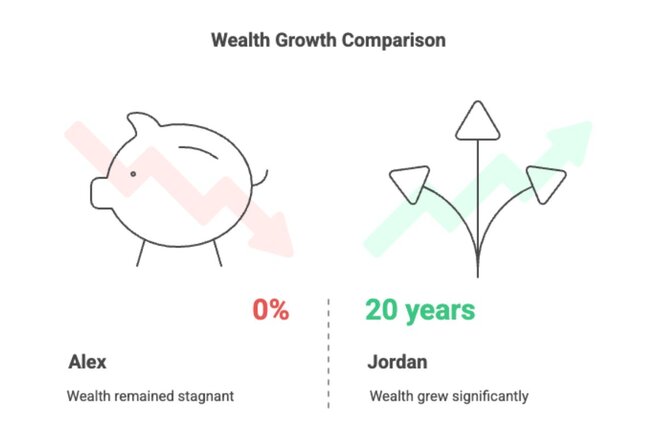

Meet Alex and Jordan: 20 years later? Jordan’s wealth grew far more. Why? Because avoiding risk = missing growth. Real risk isn't losing money—it's standing still while others grow.

What Risk Really Means

It's not just “losing money.”

It’s opportunity cost—what you miss by playing it too safe.

- Higher returns = higher risk

- Lower risk = limited growth

Smart investors don’t avoid risk. They manage it.

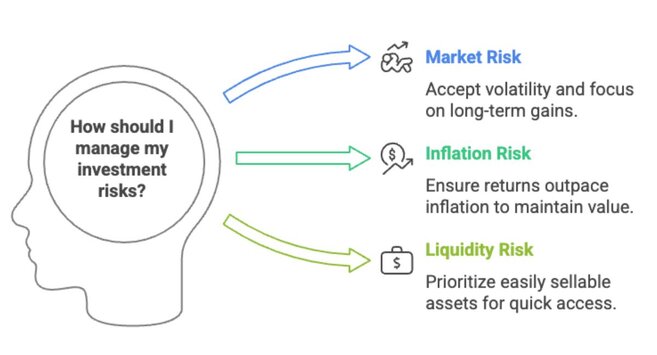

Types of Investment Risk

How to Manage Risk

- Diversify

- Think long-term

- Know your comfort zone

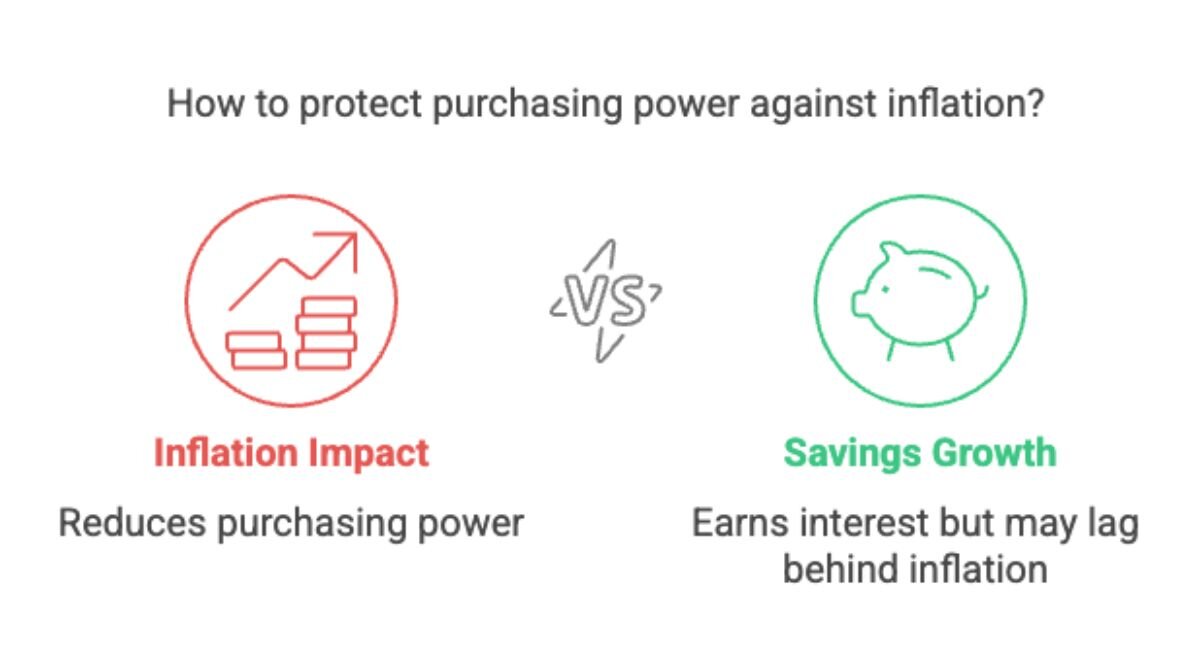

Inflation: The Silent Thief

Everything used to cost less. That's inflation. Prices rise over time → your money buys less. 🛑 Saving alone isn’t enough. If inflation is 3%, and your savings earn 1%, you're losing purchasing power. More dollars ≠ More value.

How to Beat Inflation

Invest in assets that outpace it:

- Stocks: 7–10% long-term returns

- Real estate: Values + rent grow with inflation

- Commodities: Hedge against rising prices

🔁 Know the difference:

Nominal return = what's on paper

Real return = what you keep after inflation

Time Value of Money (TVM): Why Now Beats Later

Would you rather get $1,000 today or in 5 years? Take it now—so it can start growing. 💡 Money today > Money tomorrow. Example: Waiting = expensive

Why Businesses Love TVM Because money today can be reinvested.

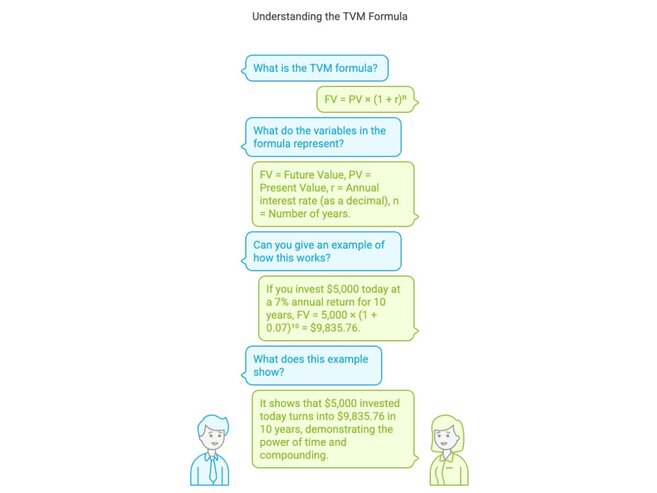

Simple TVM Formula

FV = PV × (1 + r)^n FV = Future value PV = Present value r = return rate n = years Example You invest $5,000 today at an annual return of 7% for 10 years. FV = 5,000 × (1 + 0.07)¹⁰ FV = 5,000 × (1.967151) FV = $9,835.76 💡 So, $5,000 invested today turns into $9,835.76 in 10 years. That’s the power of time + compounding.

Assignment

If inflation is 3% and your bank pays you 1%, are you gaining or losing money?

a) Gaining (because my balance is going up).

b) Losing (because my money’s purchasing power is shrinking).

c) Breaking even (because 1% is still better than nothing).

Which is riskier over 30 years?

a) Investing in a diversified stock portfolio.

b) Keeping all your money in cash.

See the answers at the bottom

Summary and Key Takeaways

Risk ≠ bad — It’s the price of growth. Manage it.

Inflation kills — Saving alone won’t save you. Invest.

Time is power — Start now, let compounding do the work.

Answers to the Quiz Questions

1) Inflation is 3%, bank pays 1%. Are you…

Answer: b) Losing – Your money’s value is shrinking.

2) Which is riskier over 30 years?

Answer: b) Keeping all your money in cash – Cash loses value over time.

Bottom line: Start early. Take smart risks. Beat inflation. Your future self will thank you.

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.