Introduction: Don't Put All Your Eggs in One Basket

Imagine putting your entire net worth into one stock…and then that company tanks. That’s the risk of being undiversified. Diversification does not guarantee profits, but it does help reduce the pain when things go wrong. In this lesson, you’ll learn:

Define the Investor Profile

Before building any portfolio, it helps to know who it’s for. Let’s create a realistic example to guide our strategy. Example Investor: Maya, Age 30 Maya is like many beginner investors: focused on long-term growth, but not looking to gamble. This profile will guide our asset allocation choices in the next section.

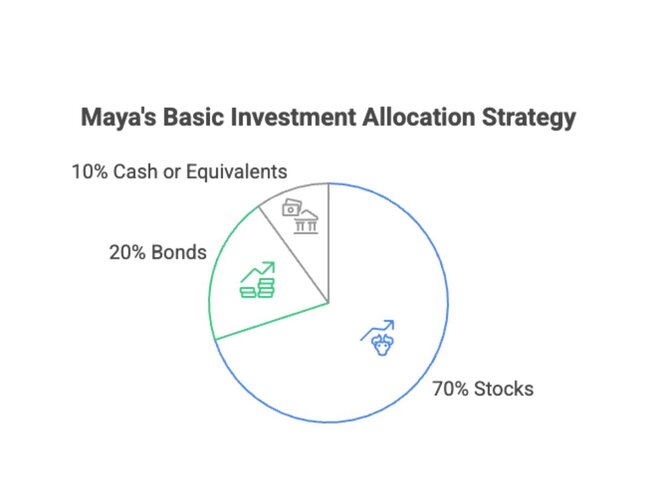

Asset Allocation Breakdown

Now that we know Maya’s profile, let’s build a portfolio that fits her goals and risk tolerance. Basic Allocation Strategy This mix suits her long-term horizon and moderate risk comfort. Why This Allocation Works for Maya: As Maya gets older, she can gradually shift more into bonds and cash.

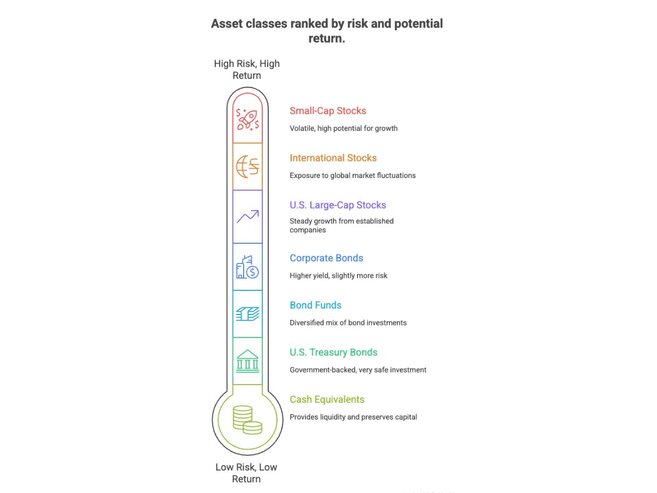

Diversification within Assets

It is not just important to hold different classes of assets. You also need to spread your bets within each category. Stocks: Spread by Geography and Company Size Bonds: Mix for Stability Cash or Equivalents Diversification reduces the risk of one area dragging down your whole portfolio.

Simulate the Portfolio: $10,000 Example

Let’s put Maya’s asset allocation into action using real investment options.

Allocation Breakdown:

- Stocks (70%) = $7,000

- U.S. Total Market (VTI): $4,000

- International (VXUS): $2,000

- Small-Cap U.S. (IJR): $1,000

- Bonds (20%) = $2,000

- Total Bond Market (BND): $2,000

- Cash (10%) = $1,000

- Held in a high-yield savings account or money market fund

How This Portfolio Performs:

- Strong growth potential from stocks

- Stability and income from bonds

- Cash for short-term needs and flexibility

Over time, this portfolio can be rebalanced, adding more to bonds as Maya nears retirement.

Quiz

What is the primary reason to diversify your portfolio?

a) To boost short-term gains

b) To reduce the risk of loss from any one investment

c) To avoid investing in stocks

If you’re 30 years old with a long-term goal, what asset class should be the largest part of your portfolio?

a) Bonds

b) Cash

c) Stocks

3.Which ETF would give you exposure to US large-cap stocks?

a) VXUS

b) VTI

c) BND

See the answers at the bottom

Exercise: Build Your Own Portfolio

- Pick a hypothetical amount to invest (e.g., $5,000 or $10,000)

- Use a basic allocation (e.g., 60% stocks, 30% bonds, 10% cash)

- Choose a few real ETFs or index funds to represent each asset class

- Break down how much you’d invest in each

Bonus: Think about what you'd adjust if your goal was shorter-term or if you had a lower risk tolerance.

Summary and Key Takeaways

- Diversification spreads risk and smooths out returns over time.

- The right mix of stocks, bonds, and cash depends on your goals, time frame, and risk tolerance.

- Simple portfolios using broad-market ETFs can be powerful and low-maintenance.

- You don’t need to be perfect; just consistent and thoughtful.

Final thought: A diversified portfolio may not beat the market, but it will help you stay invested, sleep better, and reach your goals with fewer bumps along the way.

1) What is the primary reason to diversify your portfolio?Answers to the Quiz and Exercise Questions

Quiz Answers:

Answer: b) To reduce the risk of loss from any one investment

2) If you’re 30 years old with a long-term goal, what asset class should be the largest part of your portfolio?

Answer: c) Stocks 3) Which ETF would give you exposure to US large-cap stocks? Answer: b) VTI

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.