Introduction: When The Market Tanks

Imagine waking up and seeing your portfolio down 30%. Would you stay the course, or panic and sell? Every investor faces this moment. What matters is how you respond. Market crashes feel rare and extreme, but they’re a normal part of long-term investing. Understanding them helps you avoid costly mistakes and even spot opportunities. In this lesson, you’ll learn:

Historical Examples of Market Crashes

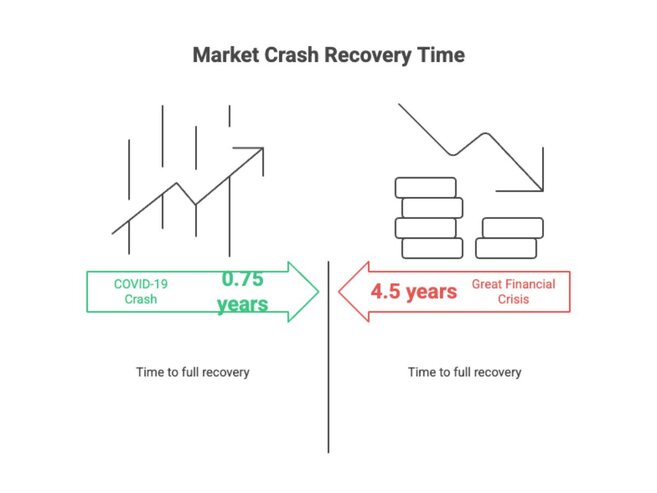

Market crashes may feel shocking, but they happen more often than you think - and recovery often comes sooner than expected. The Dot-Com Bust (2000-2002) The Great Financial Crisis (2008-2009) The COVID-19 Crash (2020) Every crash is different, but one thing stays the same: long-term investors who held on came out ahead.

What Worked During Crashes

While panic is common, history shows that calm and disciplined strategies often perform best in downturns. Staying Invested Dollar-Cost Averaging Buying Quality on Sale

What Didn't Work

Crashes tempt investors into reactionary moves, but history shows these often hurt more than help. Panic Selling Trying to Time the Market Chasing Trends Too Late Emotional decisions can feel right in the moment, but they usually backfire. Having a plan beats reacting in real-time.

Behavioral Lessons: Emotions vs. Strategy

Crashes are at least as psychological as they are emotional.

Understanding your emotions is key to making smarter decisions.

Fear Amplifies Risk

- When markets fall, it’s tempting to believe ‘this time is different’

- Fear leads to rash decisions like selling at a loss or abandoning your plan

Loss Aversion

- Losing money feels twice as painful as gaining it feels good

- This bias can push you to act defensively, even when it hurts your long-term goals

Plans > Predictions

- Investors who follow a clear, written plan are less likely to panic

- Having predefined rules (e.g., "rebalance annually") helps you stay grounded when markets shake

In a crash, your biggest enemy is not the market, but your own reaction to it.

Quiz

Which strategy historically helps most during a market downturn?

a) Selling all your stocks

b) Buying high-yield crypto

c) Continuing to invest consistently

What is loss aversion?

a) Feeling more pain from losses than joy from gains

b) Preferring safe bonds over stocks

c) Avoiding losses by investing in gold

3.What happened after the COVID-19 crash in 2020?

a) Markets stayed down for years

b) Investors who sold early avoided losses

c) Markets recovered quickly, reaching new highs within months

See the answers at the bottom

Exercise: What Would You Do?

Imagine your portfolio drops 30% overnight.

You’ve got $1,000 ready to invest.

What do you do?

- Pause all investing

- Invest it all right now

- Stick to your existing plan and keep investing monthly

Write down what you’d feel, and then what you’d do - and compare the two.

Summary and Key Takeaways

- Crashes are part of the investing journey - painful, but not unusual.

- History shows recovery is often faster and stronger than expected.

- Investors who stayed the course, kept investing, or rebalanced smartly, came out ahead.

- Emotions like fear and loss aversion are natural, but dangerous if unchecked.

- A clear and long-term plan is your best defense against panic.

You cannot control when markets fall. But you can control how you respond.

1) Which strategy historically helps most during a market downturn?Answers to the Quiz and Exercise Questions

Quiz Answers:

Answer: c) Continuing to invest consistently

2) What is loss aversion?

Answer: a) Feeling more pain from losses than joy from gains 3) What happened after the COVID-19 crash in 2020? Answer: c) Markets recovered quickly, reaching new highs within months

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.