Introduction: The Importance of Risk Tolerance

Why do some people sell the moment the market dips, while others keep buying? It all comes down to risk tolerance. This is your personal comfort level with uncertainty, volatility, and potential losses in your investments. The thing is: The stock market will go up and down, and you might lose money in the short term. But how you feel and react during those times determines your long-term success. By the end of this lesson, you’ll know:

What is Risk Tolerance?

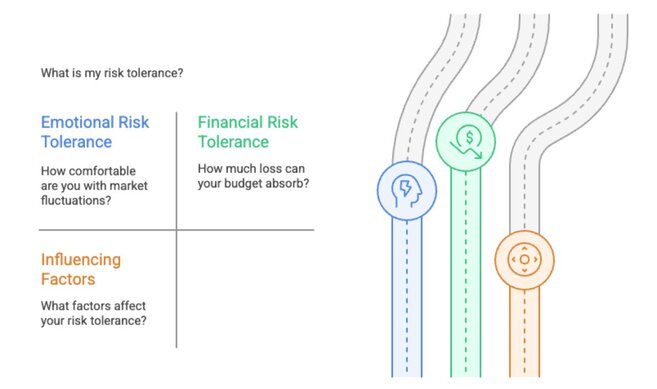

Risk tolerance refers to how comfortable you feel when the value of your investments fluctuates. It has two sides: Emotional Risk Tolerance: Financial Risk Tolerance What Influences Your Risk Tolerance? Quick Thought: Your risk tolerance isn’t fixed. It can shift with life stages, like job changes, family additions, or nearing retirement.

Types of Investors (Based on Risk Profile)

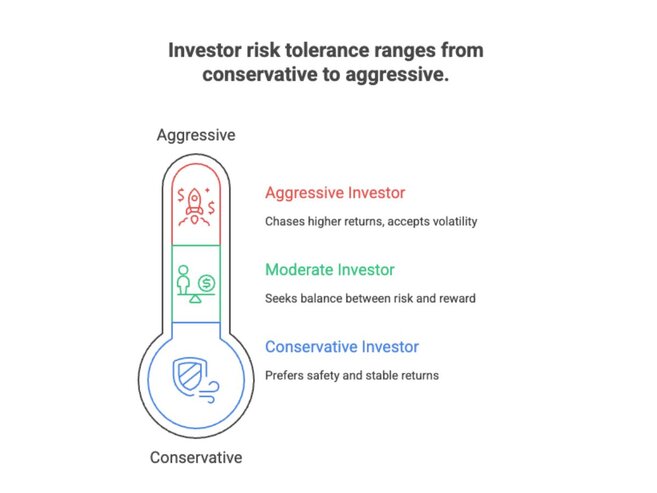

Every investor falls somewhere on the risk spectrum. Let’s meet the three main types: Conservative Prefers stability; avoids big swings Mostly cash; high-quality bonds Moderate Comfortable with some ups and downs for growth Mix of stocks and bonds Aggressive Eager for high returns; accepts volatility Mostly stocks; small amounts in alternatives Assessing Your Risk Tolerance Here are two scenarios to help you figure out your comfort level: If your portfolio loses 20% in a month, do you? a) Sell everything and stop investing? b) Hold steady and wait for a rebound? c) Buy more while prices are lower? If a steady 5% return or bumpy 8% return is possible, which would you choose? Your choice reveals your style: You can cement this understanding using free online risk quizzes; just search “investment risk tolerance test.”

Types of Investors: Which One Are You?

Knowing your risk tolerance helps you figure out what kind of investor you are. Here’s a quick breakdown: Conservative Investor Moderate Investor Aggressive Investor No type is “better”; just more suitable for your goals and comfort level. Think of it like choosing a car: a sports car, a sedan, or a hybrid… depends on the road you’re driving.

Time Horizon: The Hidden Risk Filter

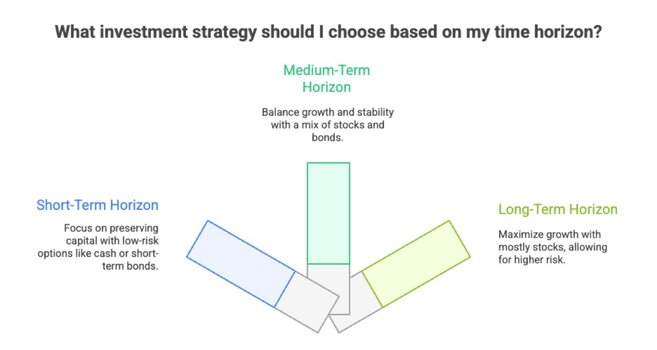

Your time horizon is how long you plan to keep your money invested before you need to use it.

And it changes everything.

Short-Term Horizon (0–3 years)

- Goal: Preserve capital.

- Risk: Even a small dip can hurt if you need the money soon.

- Best fit: Cash, high-yield savings, short-term bonds.

Medium-Term Horizon (3–10 years)

- Goal: Balance growth with some stability.

- Risk: You can handle some ups and downs, but not too many.

- Best fit: Mix of stocks and bonds.

Long-Term Horizon (10+ years)

- Goal: Maximize growth.

- Risk: Volatility becomes less scary; time smooths things out.

- Best fit: Mostly stocks, some diversification for protection.

Rule of thumb: The longer your horizon, the more risk you can afford to take.

Real-World Example: Risky Rachel vs. Cautious Chris

Meet Rachel. She’s 28, has a steady job, and plans to retire in 35 years. She’s okay with market swings because she knows she won’t touch her investments for decades.

Meet Chris. He’s 50, planning to retire in 10 years. He still wants growth, but without the rollercoaster ride.

Let’s say both invest $100,000:

Year 1

Rachel (80% stocks, 20% bonds)

Chris (40% stocks, 60% bonds)

$108,000

$104,000

Year 2

$117,000

$108,200

Year 3

$102,600 (market dips)

$103,000

Year 4

$114,000

$108,000

Year 5

$123,000

$112,500

Over time, Rachel’s portfolio bounces around more, but grows faster.

Chris’s returns are smoother, but smaller.

Why?

Rachel has time on her side. She can afford to ride the ups and downs.

Chris is closer to needing his money, so he trades off some growth for stability.

The takeaway: Your ideal risk level depends not just on personality, but on timing.

Quiz

Which investment strategy helps manage risk best?

a) Putting all your money into one stock

b) Timing the market frequently

c) Diversifying across stocks, bonds, and cash

What does risk tolerance measure?

a) How much money you want to invest

b) Your emotional and financial ability to handle investment ups and downs

c) The speed at which your investments grow

See the answers at the bottom

Summary and Key Takeaways

- Risk tolerance is personal. It’s not about being brave, but about knowing how much volatility you can handle without losing sleep (or pulling out your money at the worst time).

- Staying invested is key. The market will have ups and downs. The investors who succeed are the ones who stay the course - even when it’s bumpy.

- Match your strategy to your comfort zone. Don’t copy someone else’s portfolio. Build one that fits you.

- Risk tolerance changes. As your life evolves - income, goals, age - so should your strategy. Reassess every few years or after big life changes.

1) Which investment strategy helps manage risk best?Answers to the Quiz Questions

Quiz Answers:

Answer: c) Diversifying across stocks, bonds, and cash

2) What does risk tolerance measure?

Answer: b) Your emotional and financial ability to handle investment ups and downs

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.