Introduction: Know the Playing Field

You can find a great company with a great product… But if it’s operating in a shrinking or overly crowded market, it may still underperform. That’s why investors don’t just study the business, but also the market the business is in. If you understand what’s going on in the broader market, you’ll make calmer, better decisions. In this lesson, you’ll learn how to:

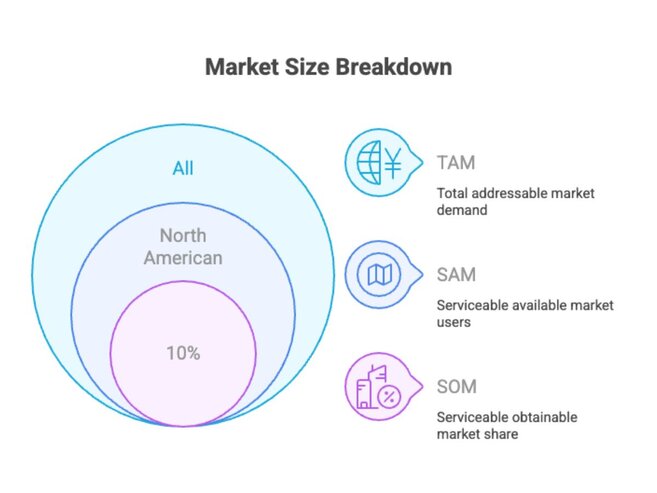

TAM, SAM, SOM: Sizing the Opportunity

When evaluating a company’s potential, it helps to understand the size of the market it’s targeting, and how much of the market it can realistically win. These three layers break it down: TAM (Total Addressable Market) This is the biggest number: the total demand for a product or service across the entire market. Example: For a global streaming platform, TAM could be all entertainment streaming revenue worldwide. SAM (Serviceable Available Market) A narrower slice: the part of the market the company can actually serve based on its offerings and reach. Example: A U.S.-only streaming service might only be able to reach North American streaming users. SOM – Serviceable Obtainable Market The realistic share the company could capture in the near term. It considers competition, budget, customer acquisition, and brand power. Example: Food Delivery App These layers help investors separate vision from reality, and gauge how much room there is to grow.

Competitive Dynamics: Who’s in the Ring?

A company competes for customers, market share, and attention. Understanding who the competitors are and what makes your company different is essential to evaluating its edge. Identify the Main Competitors Example: For Zoom: What Makes This Company Stand Out? Optional Tool: SWOT Analysis A quick way to map the company’s position: Strengths What the company does well Weaknesses Internal limitations or gaps Opportunities Market trends to capitalize on Threats Competitive risks or regulation Investors should ask: Is this company a leader, challenger, or newcomer in its space, and how is it positioned to win?

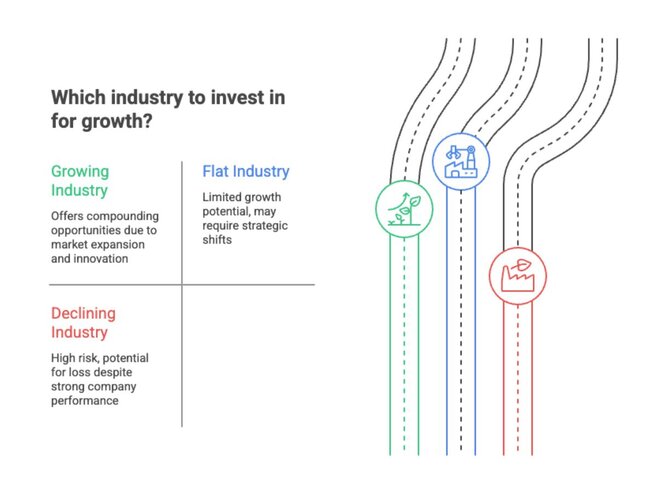

Industry Growth Trends

Even with great leadership and strong products, a company in a stagnant or shrinking market will find growth to be an uphill battle. Investors look for industries with tailwinds - sectors expected to expand due to trends, technology, or shifts in behavior. Key Questions to Ask: Common Growth Drivers: Example: Cloud Computing A fast-growing company in a fast-growing industry = compounding opportunity But even the best company can struggle if its industry is in decline.

Important External Factors

Even a strong company in a hot market can hit roadblocks from forces outside its control.

Smart investors look beyond the company and industry to broader macro and regulatory factors.

Regulation

- Can create headwinds or tailwinds:

- Example: EV tax credits = boost for electric car companies

- Example: Data privacy laws = challenge for ad-driven tech firms

- Ask: Is the company helped or hurt by current and upcoming regulations?

Macroeconomic Conditions

- Interest rates, inflation, currency risk, and global supply chains can impact margins, demand, and cost of capital

- Some industries (like housing or luxury goods) are more rate-sensitive than others

Global vs. Local Exposure

- A company heavily reliant on international sales might face:

- Geopolitical risks

- Currency fluctuations

- Trade restrictions or tariffs

External factors won’t show up on the balance sheet, but they often show up in earnings surprises.

Quiz

What does TAM stand for?

a) Total Addressable Market

b) Targeted Allocation Market

c) Tracked Active Margin

What's a moat in marketing?

a) A sustainable competitive advantage that protects a company from rivals

b) A measure of customer loyalty

c) A type of profit margin

3. Why is SOM more important than TAM in early-stage analysis?

a) It’s easier to calculate

b) It reflects the company’s actual near-term opportunity

c) It includes global market data

See the answers at the bottom

Exercise: Analyze a Company’s Market Position

Choose any company you're interested in.

Then:

- Research and estimate its TAM, SAM, and SOM

- List 2–3 main competitors

- Identify one major industry trend and one external factor (regulation or macro)

This exercise helps you understand not just the company, but the world it operates in.

Summary and Key Takeaways

- A company’s success depends not only on internal strengths, but also on the market it operates in.

- TAM, SAM, and SOM help you size the opportunity and understand how much market share is realistically achievable.

- Knowing the competitive landscape and a company’s moat is crucial for judging long-term potential.

- Industry growth trends and external forces (like regulation or economic shifts) can boost or block performance.

- Smart investing means looking beyond financials. Context matters.

Final thought: Great businesses thrive in growing markets with room to lead. That’s where real investment opportunities live.

Answers to the Quiz and Exercise Questions

Quiz Answers:

1) What does TAM stand for?

Answer: a) Total Addressable Market

2) What’s a moat in marketing?

Answer: a) A sustainable competitive advantage that protects a company from rivals 3) How are qualified dividends usually taxed? Answer: a) At the long-term capital gains rate

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.