Introduction: Why Timing the Market Is So Hard

No one knows exactly when the market will go up or down. Not even the pros. But that’s okay. Because there’s a strategy that doesn’t require you to guess: Dollar-Cost Averaging (DCA). Instead of trying to buy low and sell high, DCA helps you invest consistently, no matter what the market’s doing. In this lesson, you’ll learn:

What is Dollar-Cost Averaging?

Dollar-Cost Averaging (DCA) means you invest the same amount of money at regular intervals, no matter what the market’s doing. You don’t try to time the market or wait for the perfect dip. You simply invest. Steadily. You decide to invest $500 every month into an index fund. Over time, this averages out your purchase price and lowers the risk of going “all in” at the wrong moment.Example:

How DCA Helps You Win Over Time

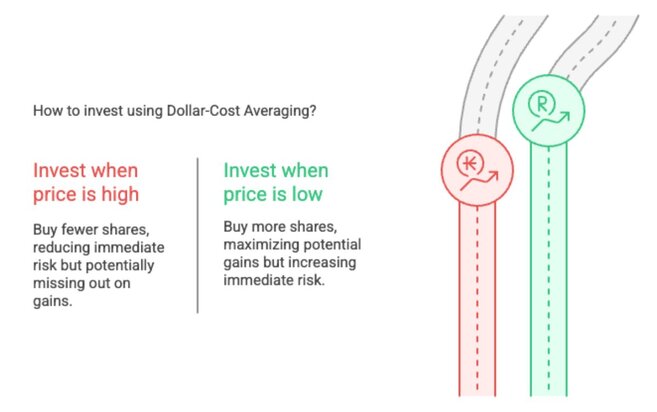

Markets go up. Markets go down. But DCA keeps you moving forward, calmly and consistently. This is how it helps: Reduces Emotional Investing DCA means you're not constantly wondering, “Should I buy now? What if the market crashes tomorrow?” You invest on a schedule, and that’s it. No second-guessing. Buys More When Prices Drop When prices fall, your fixed investment amount buys more shares. When prices rise, it buys fewer. This helps average out your cost per share, and smooths your entry into the market. Builds a Strong Habit DCA turns investing into a routine. It’s less about market moves and more about consistency, which is where real wealth builds.

DCA vs. Lump-Sum Investing: Which Is Better?

You’ve got two ways to invest a chunk of money: Option 1: Lump-Sum Investing Invest the entire amount right away. Option 2: Dollar-Cost Averaging (DCA) Break it into smaller, regular investments over time. So which one wins? Lump-Sum DCA Bottom line:

Step-by-Step: How to Implement Dollar-Cost Averaging

DCA is one of the easiest investing strategies to automate.

Here’s how to put it into action:

Step 1: Choose Your Investment Amount

Pick a fixed amount you can comfortably invest each month (e.g. $100, $250, $500).

Tip: Start small. You can always increase later.

Step 2: Pick Your Investment

Common choices:

- Index funds (like S&P 500 ETFs)

- Mutual funds

- Robo-advisors with diversified portfolios

Step 3: Set Your Schedule

Choose a consistent interval:

- Monthly is most common

- You could also go weekly or biweekly

Step 4: Automate it

Set up recurring deposits through your broker or investment app.

Many platforms let you auto-invest on a schedule.

Set it and forget it. The less you have to think about it, the more consistent you’ll be.

Real-World Example: DCA vs. Lump-Sum in a Volatile Year

Let’s say both Alex and Jordan want to invest $6,000 in a stock index fund.

Jordan (Lump Sum)

Jordan invests all $6,000 on January 1st.

Alex (Dollar-Cost Averaging)

Alex invests $500 every month for 12 months.

Now imagine the market dips mid-year, then recovers by December.

Here’s how things might play out:

Month

Market Price

Shares (Jordan - Lump)

Shares (Alex - DCA)

January

Market Price $100

Shares Jordan 60.0

Shares Alex 5.0

February

Market Price $90

Shares Jordan 0

Shares Alex 5.56

March

Market Price $80

Shares Jordan 0

Shares Alex 6.25

April

Market Price $70

Shares Jordan 0

Shares Alex 7.14

…

December

Market Price $100

Shares Jordan 0

Shares Alex 5.0

Total:

Jordan 60.0 shares

Alex 66.5 shares

Outcome:

- Jordan (lump sum): Ends up with 60 shares

- Alex (DCA): Ends up with more shares, because she bought more during the dip.

If the share price ends the year back at $100, Alex’s portfolio is worth $6,650.

Jordan’s is worth $6,000.

Moral of the story: In volatile markets, DCA can help you buy low and grow more, without needing a crystal ball.

Quiz

What happens when you DCA into a falling market?

a) You lose more money because the market keeps dropping

b) You automatically buy more shares at lower prices

c) You stop investing until the market recovers

See the answer at the bottom

Exercise: Create Your Own DCA Plan

Imagine you can invest $300/month.

Here’s how to build a simple DCA strategy:

- Pick your amount → Example: $300

- Choose the interval → Monthly

- Pick an investment → (e.g. S&P 500 ETF or diversified index fund)

- Set it to repeat automatically with your broker

Now ask yourself: Would I stick to this plan even during a downturn?

That’s where the power of DCA really shows up.

Summary and Key Takeaways

- You can’t control the market, but you can control your habits.

- Dollar-cost averaging helps you invest consistently without stress.

- It is an effective way to avoid bad timing and reduce emotional decisions.

- Over time, DCA builds wealth through steady, disciplined action.

In investing, consistency often beats brilliance. DCA makes consistency automatic.

1) What happens when you DCA into a falling market?Answers to the Quiz and Exercise Questions

Answer: b) You automatically buy more shares at lower prices

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.